Marketing strategy of Ashok Leyland

Ashok Leyland is an Indian multinational corporation established in 1951. It is the flagship company of the Hinduja Group and is currently headquartered in Chennai, India. It serves its offerings worldwide and has six subsidiaries to its name.

It is one of India’s leading vehicle manufacturers that offers a comprehensive range of small, medium, and heavy commercial, and passenger vehicles and is also a self-reliant unit, engaged in the business of manufacturing, assembling, and marketing commercial vehicles, automobiles all over the world.

It is a public limited company listed on the NSE and BSE in India.

Products of Ashok Leyland

- Trucks

- Buses

- Light Vehicles

- Power Solutions

- Defence Vehicles

- Spares

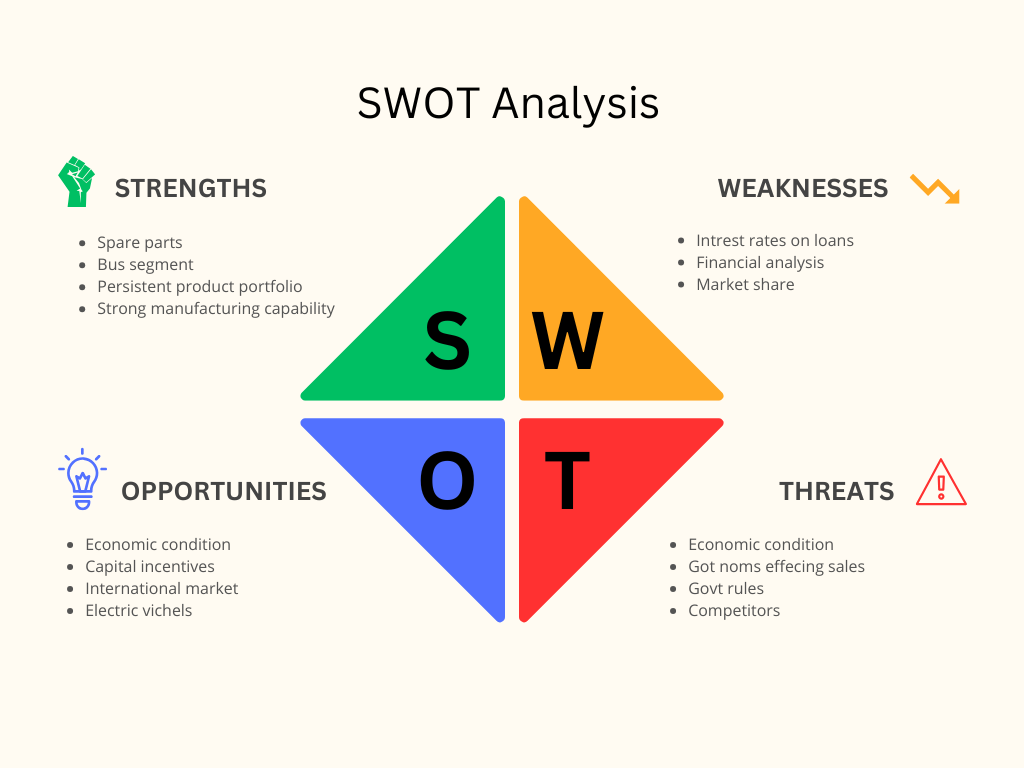

SWOT ANALYSIS

Lets discuss about various types of Marketing strategy adopted by Ashok leyland

- Product Strategy

- Price Strategy

- Place & Distribution Strategy

- Social media Strategy

Product Strategy of Ashok Leyland

Ashok leyland manufacture a huge segment of vehicles ( small,mid and large) . This huge segment line allows customers to pick perfect choice according to their requirements. They produce personal , commercial and Defence sector vehicles that makes him stand strong among his competitors

Price Strategy of Ashok Leyland

Due to its high vale driven policy they are performing los of research and development to ensure high safety and quality for all kinds of vehicles. Due to their high standard price they are more focusing on quality rather than quantity which means a customer is getting better quality as compared to their competitors . Which means Ashok leyland vehicles require less maintenance and longer life span

Place & Distribution Strategy of Ashok Leyland

Ashok Leyland intelligently placed their vehicle segments to International sector also. So their strong presence is not showcasing only in India but also overseas like UAE, UK ,Sri Lanka etc. And if talking about Indian sector they have strong presence in Maharashtra, Tamil Nadu, Uttarakhand, Hosur, Rajasthan.

Social Media Marketing Strategy of Ashok Leyland

Ashok Leyland has a wide social media presence. They are present on all major social media platforms which include Twitter, Instagram, Facebook, and YouTube. They frequently release videos related to the company from financial performance analysis to campaign videos to connect well with their stakeholders and customers.

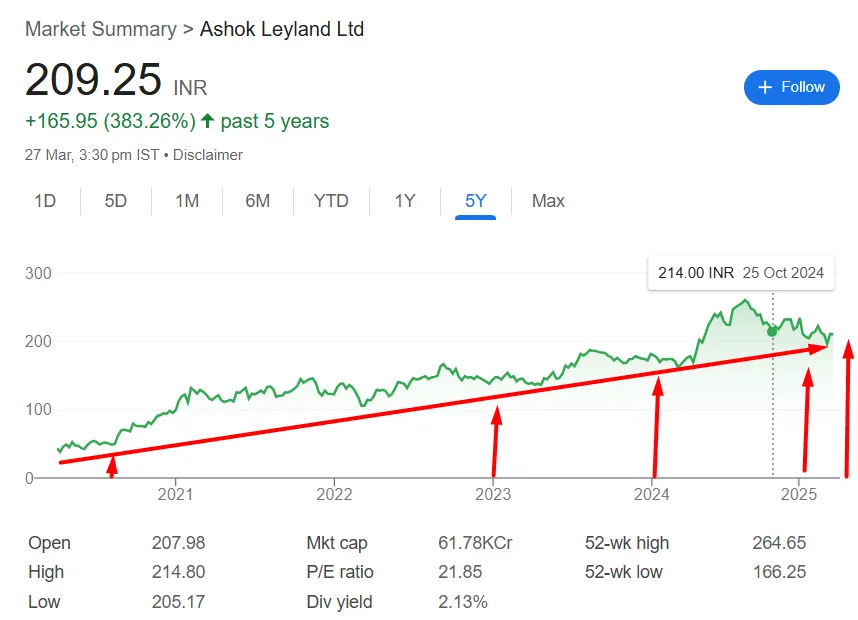

Current share market Analysis of Ashok Leyland

Ashok Leyland has built itself a niche in the Indian commercial vehicle business. Its name is widely recognized pan-India and globally. They keep a very close eye on their competitors on the business fronts. However, on the digital fronts, it needs to figure out its social media marketing plan to create a strong overall digital presence which will help them in maintaining trust, recognition, and a strong brand reinforcement in the minds of customers.

The company has a bright future ahead in the commercial vehicle industry and this company has already made plans according to future requirements and demands of the customers. They are also creating new models and designs according to a new trend that will prevail over the markets across the world.

Ashok Leyland 5 yeears share Price chart analysis.

Ashok Leyland Share Price Chart

Ashok Leyland Share Price in last 5 yeas consistent growing in March 2020 its was INR 43. Now in march 2025 it is INR 209. According to analysis, Taking into account both their development goals and key relationships within India as well as global commercial vehicle industry expansion. Ashok Leyland share price will increase in coming years and its a golden time for investors to buy good share of company

Ashok Leyland Ltd has long been recognized for their dedication and expertise in manufacturing commercial vehicles for India’s transportation infrastructure, while meeting customer needs and adapting to ever-evolving industry demands.